Free to copy: A Finnish model for the digitization and automation of taxation

A well-functioning, efficient, sustainable and predictable taxation is a competitive advantage for Finland. Global tax reforms are gradually pushing countries’ domestic tax models towards a more harmonized tax regulation. However, this has also caused an immensive amount of new international tax reporting. This highlights the importance of a well-functioning and less-burdensome taxation procedures. Reporting and paying fair share of taxes should not result in tax disputes, double taxation, excessive and administrative burdens, especially hitting the SMEs hardest as the relative administrative burden is heavier on them.

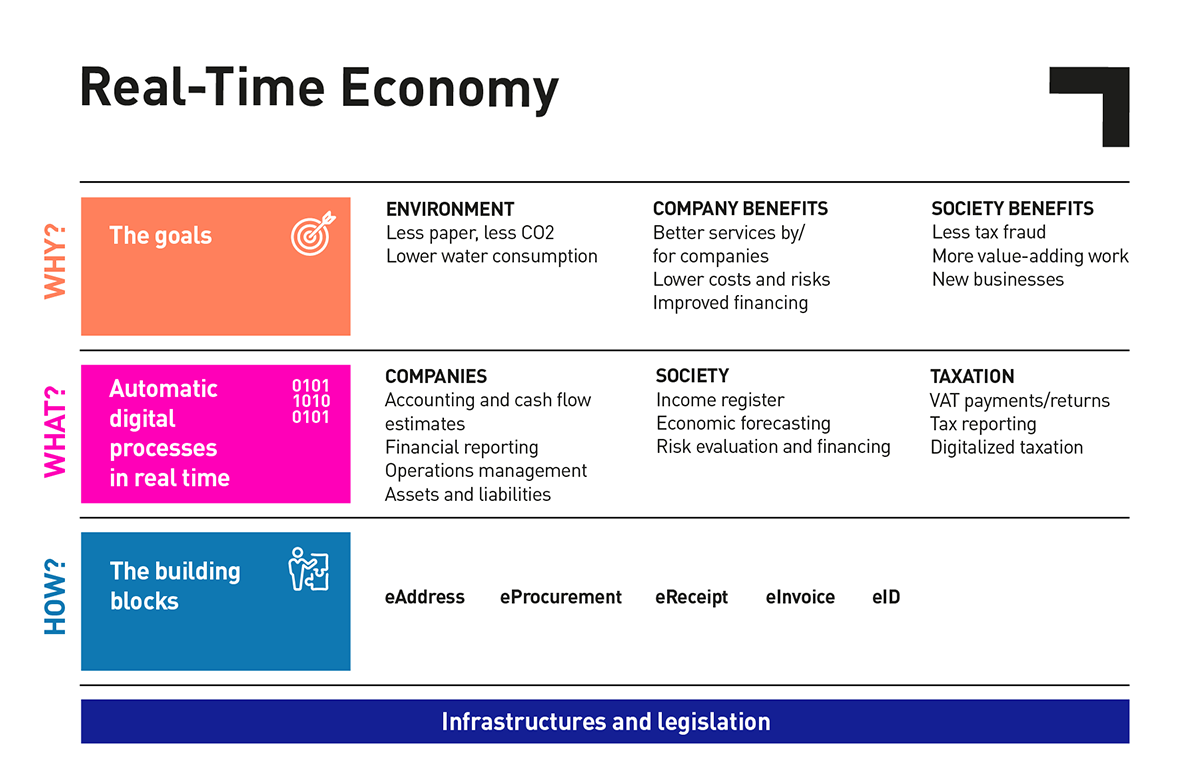

Technology Industries of Finland (TIF) promotes Real-Time Economy (RTE) and digitalization and automation of the taxation procedure in Finland and globally. RTE is an environment where financial and administrative transactions connecting citizens, businesses and public sector entities are in structured standardised digital format, generated automatically and completed in real time (or right-time).

Digitization and automation of taxation, invoice- and receipt-specific reporting must be designed in cooperation with companies and built to promote RTE. It is also important to influence the drafting of tax legislation in the EU. The goal should be that administrative work and expenses are reduced and the predictability of taxation is improved.

Benefits for companies and tax administration

Constantly increasing tax reporting obligations - each country and each tax type have their own - are a huge burden for companies. RTE and digitalisation of taxation could lead to notable savings in process and compliance costs both to companies and tax administrations. Lower administrative burden allows the companies to concentrate on their core business and contribute to boosting growth, increase employment and tax revenue. There are also huge opportunities and value of structured, standardised data on transactions that could serve as a unique European basis for financial and other digital services. RTE can bring companies also new business. Digitalization of taxation and RTE are also tools for green transition. More examples of the benefits of RTE can be found in the picture below.

The Commission has stated in its “Identifying and addressing barriers to the Single Market that compliance costs related to business taxation for SMEs can be as much as 30% of taxes paid. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: Identifying and Addressing Barriers to the Single Market, SWD/2020/54 final.

Companies must be supported in the transition

The various reporting models used in the EU Member States result in significant costs for companies, of which the majority falls to be paid by SMEs. However, it must be noted that changes in the digitalization of taxation also incur considerable costs for companies and tax administrations, especially in the initial stage. Companies should be supported in the transition.

Tax reporting reforms must be done together with other EU countries in a uniform manner. Interoperability is the key. Changes must be as harmonised as possible, without domestic deviations. Legal changes must be agreed well in advance and be clearly defined. National reporting requirements that differ from other EU Member States should not be introduced in Finland.

- Real-time, transaction-specific, structured data must also be usable by companies and move as seamlessly as possible through interfaces between systems and organizations. The goal is that the company's own financial management systems automatically produce the necessary reporting information, when possible.

- TIF supports that the development of VAT reporting in the EU is based on using e-invoicing data, as in the VAT in the Digital Age (ViDA) directive proposal.

- The transition towards RTE should be promoted also in domestic projects (e.g. Real-Time Economy project).

Active influencing in the EU

Although RTE is being enhanced in various EU Member States, the implementation of the RTE building blocks is different in each country. The EU could steer the RTE development. But to do so, the EU should have a clear vision and ability to lead the process to develop the building blocks together with the businesses to reach interoperability and competitive, multi-player market in elements of real-time economy in the EU. Finland should actively and at an earlier stage participate in international tax drafting in the EU and the OECD. An international model should be the primary goal, if possible, as it is also better for the relative competitiveness of Finnish companies. Finland's hard work in digitizing and simplifying taxation should be taken as an example.

- Finland should have a consistent, clear vision and guidelines for the desired direction of EU tax policy, so that Finland can influence the EU in a timely manner. The drafting of EU tax policy guidelines should be included in the new government program of 2023.

- The work program of the new commission 2024 should include a goal of easing the administrative burden of tax reporting more widely, including corporate income taxation, transfer pricing and withholding taxation. More tax reporting obligations should not be imposed on companies, but companies should be supported, e.g. in applying the complex reporting rules of the Minimum Tax Directive.

- The European Commission should do a thorough examination of the benefits and costs of RTE within the single market should be conducted. Such analysis would be followed by creating a “RTE for the EU” task force. The work of the expert group should result in a concrete RTE roadmap including solutions and timelines towards RTE in the EU.

- A holistic EU model should be built on the best practices of all Member States’ such as the Nordic and Baltic states’ work with digitalisation and automation of taxation as well as Real-Time Economy. The EU should encourage, observe and coordinate Member State actions, investigate experiments and ensure financial support for development, when needed.

Read more:

Statement on the VAT in the Digital Age

Statement on the VAT in the Digital Age directive proposal